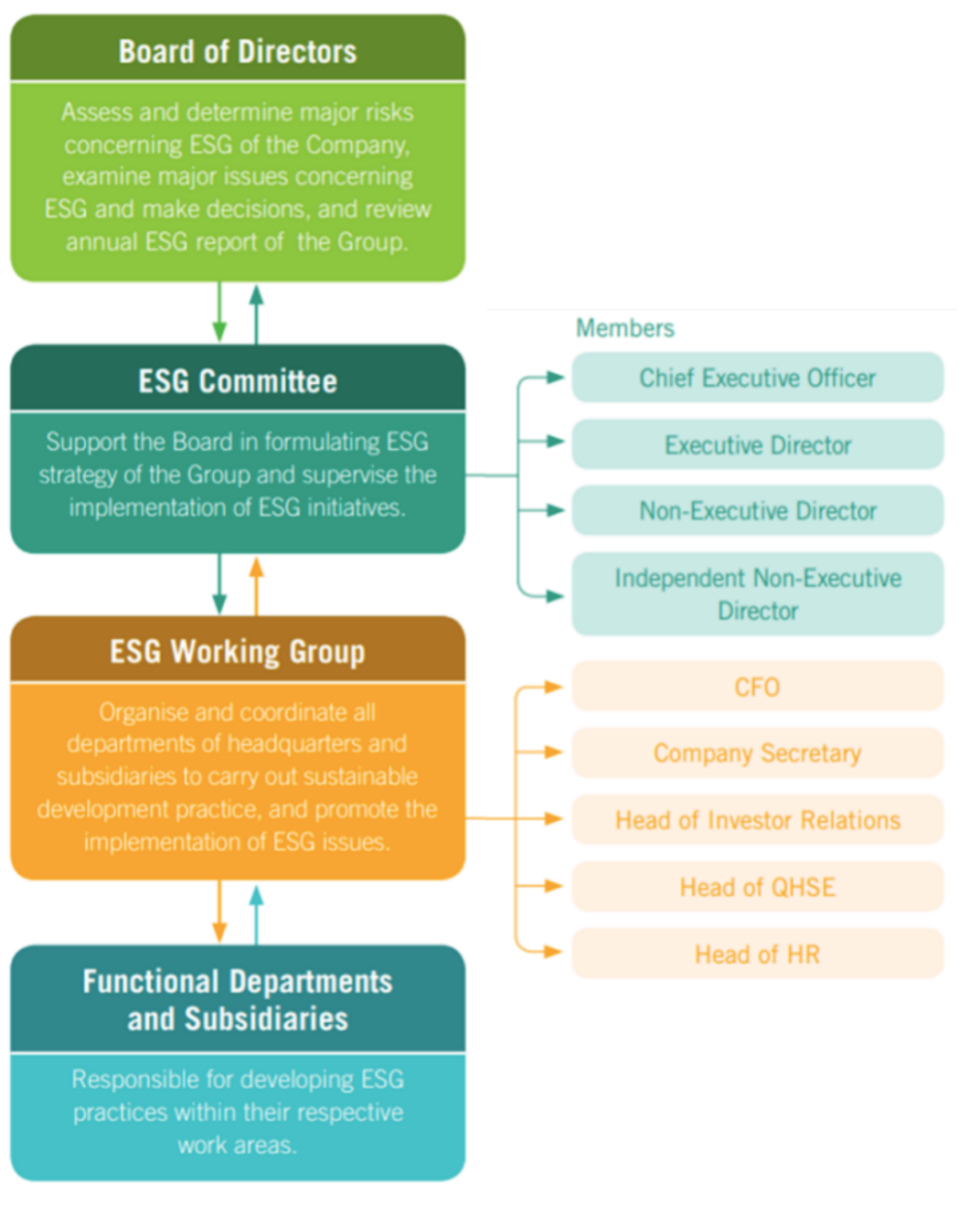

The Board of Directors attaches great importance to ENN Energy's sustainable development performance, and has established an ESG Committee to assist it in formulating the Company's ESG-related strategies and supervising the implementation of ESG initiatives. An ESG working group has been set up under the ESG Committee to ensure that risks related to all aspects of ESG are properly managed and implemented.

ESG Indicators and Compensation

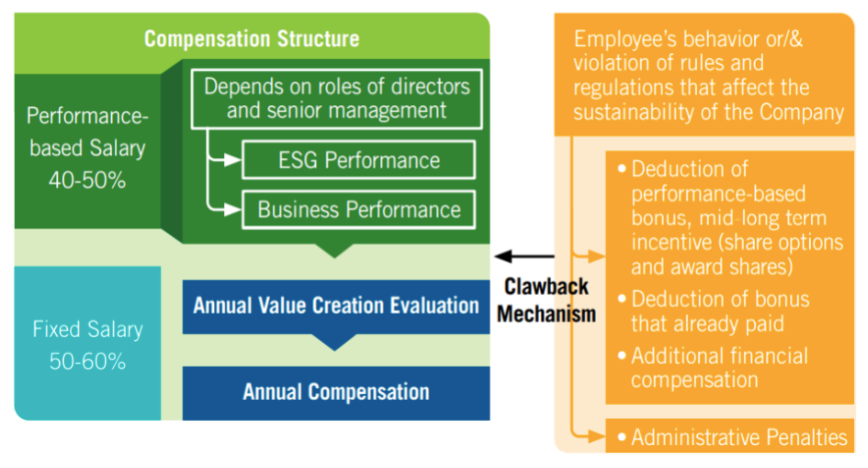

In order to deepen ESG governance and ensure the achievement of ESG related performance, the Company has linked management compensation to ESG indicators.

We have included carbon reduction assessment, biodiversity conservation, environmental management improvement, supplier ESG management, renewable energy application, health and safety, customer satisfaction, anti-corruption, and compliance operation, etc. into the annual value creation evaluation plan of provincial and member subsidiaries. The evaluation results will affect the total amount of incentives for the subsidiaries, forming a sustainable development-linked value-added evaluation and incentive system.

The Company is committed to upholding good corporate governance practices. The corporate governance principles of the Company emphasise on an effective board, prudent internal and risk control, transparency and quality disclosure and accountability to shareholders. The board of directors (the "Board") and the management of the Company have been continually reviewing and enhancing the corporate governance practices with reference to local and international standards. The Board believes that its continued efforts in enhancing the Company's corporate governance practices have, directly and indirectly, contributed to the strong business growth of the Company and its subsidiaries (the "Group") in the past years.

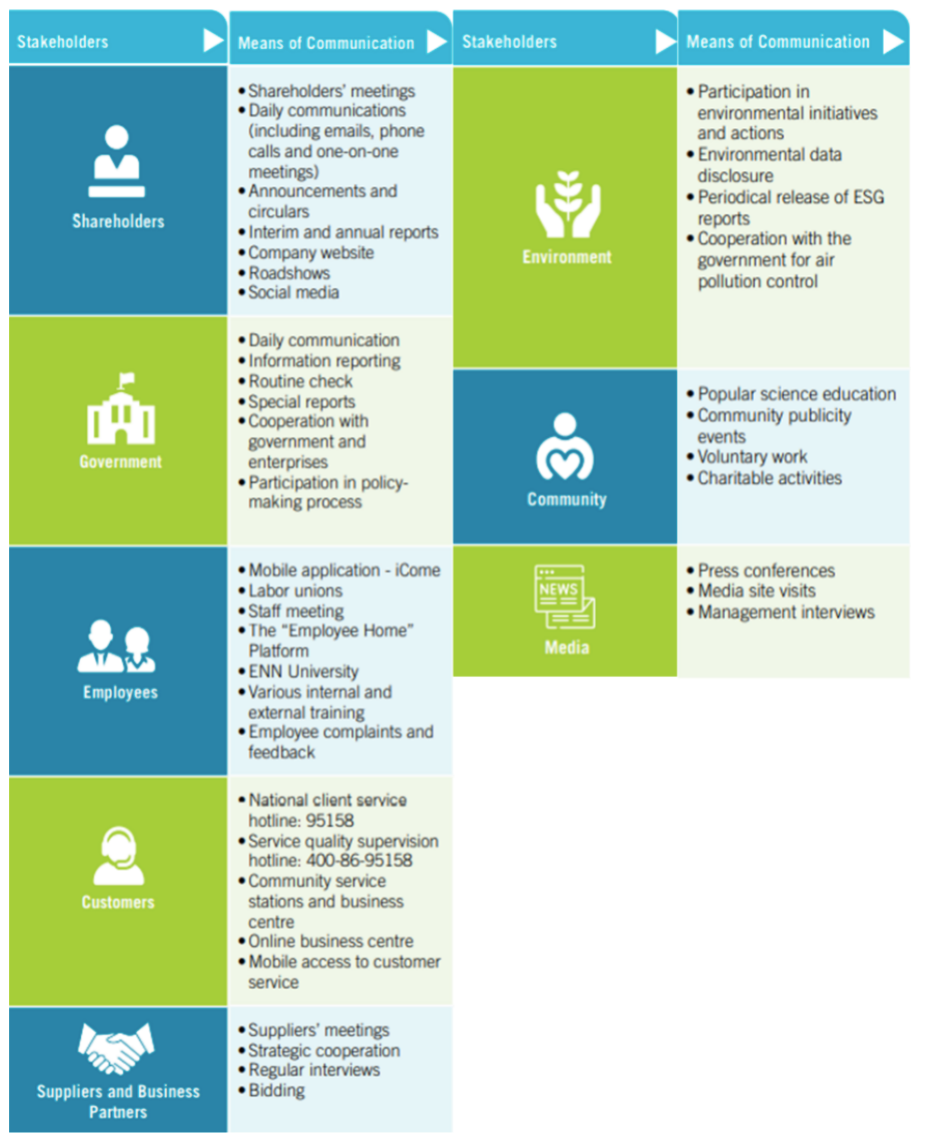

ENN Energy highly values the opinions of stakeholders and has established multiple channels to communicate with stakeholders to understand their requests and expectations and subject to their supervision.

Green finance is a core part of the company's commitment to sustainability and ESG investment into its business and project investment cycle. The company consciously applies green bonds and other sustainable finance product to fund projects with positive environmental and social benefits. By incorporating ESG metrics into regulations, actions, procedures and standards for investment behavior, it is able to regularly monitor and report on the environmental and social benefits of ESG investment projects. Meanwhile, ENN Energy also supports the United Nations Sustainable Development Goals ("SDGs") as defined at the 2015 United Nations Sustainable Development Summit in the process of project investment and construction.

The company has established a Green Finance Framework that sets out how it proposes to use the amount equal to net proceeds to finance or refinance on green projects that in line with the company development strategy, so as to support the company to achieve long-term sustainable development.

ENN Energy Green Finance Framework aligns with the 2018 Green Bond Principles ("GBP 2018") of the International Capital Market Association, the 2020 Green Loan Principles ("GLP 2020") developed by the EMEA Loan Market Association, Asia Pacific Loan Market Association and Loan Syndications & Trading Association, and has received Second-party Opinion issued by Vigeo Eiris.

Vigeo Eiris expressed a "reasonable assurance" (their highest level of assurance) on the company's commitments and on the contribution of the Framework to sustainability, with the opinion that the Framework is aligned with the four core components of the GBP 2018 & GLP 2020, namely Use of Proceeds, Process for Project Evaluation and Selection, Management of Proceeds and Reporting.

Besides, the Framework has been certified by the Hong Kong Quality Assurance Agency (HKQAA) under the Green Finance Certification Scheme.

On September 10, 2020, the Company successfully issued its first green bond of $750 million with a coupon rate of 2.625% due in 2030. This green bond was well received by investors and was added to the Hong Kong Sustainable and Green Exchange (STAGE).

By the end of 2020, the green bond had been fully allocated to eligible green projects, of which the investment amount of methane management projects accounts for 13%, the investment amount of renewable energy utilization projects accounts for 11%, the investment scale of integrated energy solutions accounts for 53%, and the investment scale of waste heat utilization and integrated energy projects accounts for 23% (see p.57 of ENN Energy’s 2020 ESG report), and obtained the Post-Issuance Certification of Green Bonds from the Hong Kong Quality Assurance Agency.